Economists Think Dollar's Fall May Explain the Recent ‘Rally’ by Steve Liesman

Einstein taught us about relativity in nature. Now come Devina Mehra and Shankar Sharma of First Global to teach us about relativity in financial markets -- and raise some serious questions about just what is driving stock prices.

First Global reports are quite credible and, on occasion, more than that.

What prompts this mention is Intel's earnings report and the fact that First Global has had a pretty good bead on the company and its stock.

AMD up again following First Global upgrade to ‘buy’ (AMD) By Tomi Kilgore

Analyst Kuldeep Koul at First Global upgraded Advanced Micro Devices (AMD) to "buy" from "outperform," given the "exceptional traction" that the chipmaker's Opteron line of processors has been able to get.

Baidu Climbs on First Global’s ‘Outperform’ Outlook

Baidu Inc., the operator of China’s most-used Internet search engine, rose to the highest price in two weeks after First Global rated the shares “outperform? in new coverage.

Personality counts: Walmart's frugal, but Target charms

"It's better to take a slight hit on [profit] margins and keep on moving and inventing," says First Global Securities. And at least for now, Target is inventing in a way that appeals to consumers with money to spend.

Dead Batteries

At 11 times trailing earnings, Energizer is cheaper; Gillette's multiple is 25. But cheaper doesn't mean better, says First Global.

Bipinchandra Dugam @bipinchandra90

@devinamehra @firtglobalsec

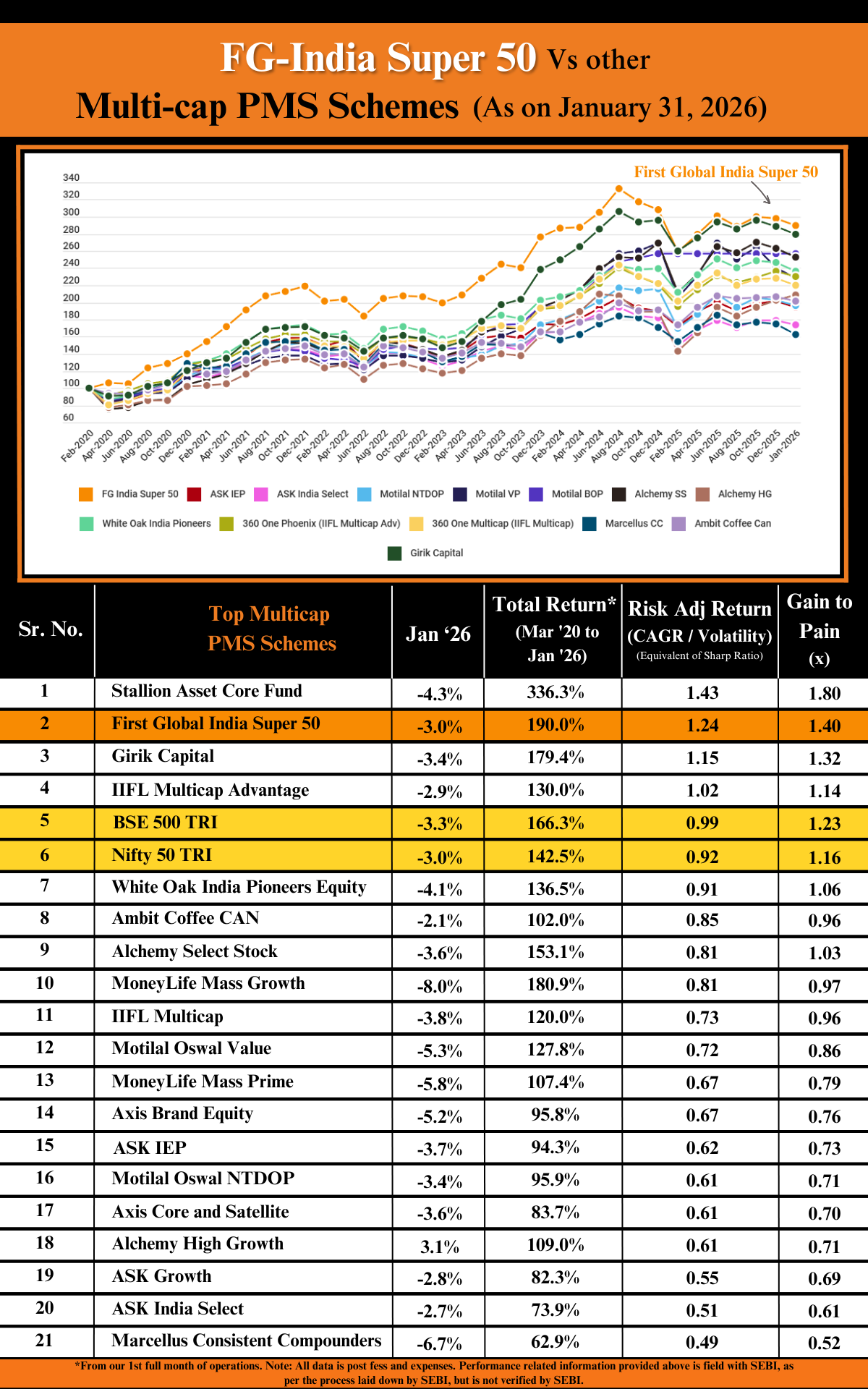

invested in both GFF-GTS and Super I50. Thank you very much for such wonderful investing experience with completely new approach. In my 15years of investing first product I felt which close to what customer want.

Shishir Kapadia @shishirkapadia1

@firstglobalsec @devinamehra

by far you are the best, I have not come across transparency, acumen, global expertise, exposure, protection of capital, delivering return from any fund/ fund managers. Invested very small size in 3 products will keep on increasing it over the period

Sumeet Goel @GoelSumeet

Very happy & relaxed to be invested with first global pms

Shishir Kapadia@shishirkapadia1

Congratulations on super performance, above all transparency and systematic process are unmatchable.

One must opt this, if person consider him/her self as an investor. Very happy to be part of this since invested. FG has managed worst year (ie 2022) so efficiently and skillfully.

SY @SachinY95185924

With so much of volatility in the market, risk management is very important part & considering that FG is doing awesome work!!! Kudos to you Chief

Amit Shukla @amitTalksHere

Truly outstanding. As a retail subscriber to #fghum #smallcase, I can vouch for the Nifty beating returns (8% vs 3%) in last 1 year. Keep up the awesome work @firstglobalsec

We can load above testimonials on site as a scroller, and just below that we can add a section for compliments . Below tweets are comments and praises are related to our content, performance and some our direct compliments to you.

ADIT PATEL @ADITPAT11226924

Good team...

Special mention @KarmathNaveen .. he is soo helpful anytime of the day or night..

Hindustani @highmettle

Bought Peace with FG-Hum.Moving all funds from DIY investing to well managed and diversified PF at low cost.

It has doubled almost, excellent pick.Every small investor must invest in her FG-HUM Smallcase.

Suresh Nair @Suresh_Nair_23

I have 8 small cases and your has been the most rewarding ones .. thank you Devina.

Sayed Masood @SayedM375

There is absolutely no doubt that she is one of the best investors of India in modern times but more importantly, she shares the most sincere and sane advice with retail investors.

SY @SachinY95185924

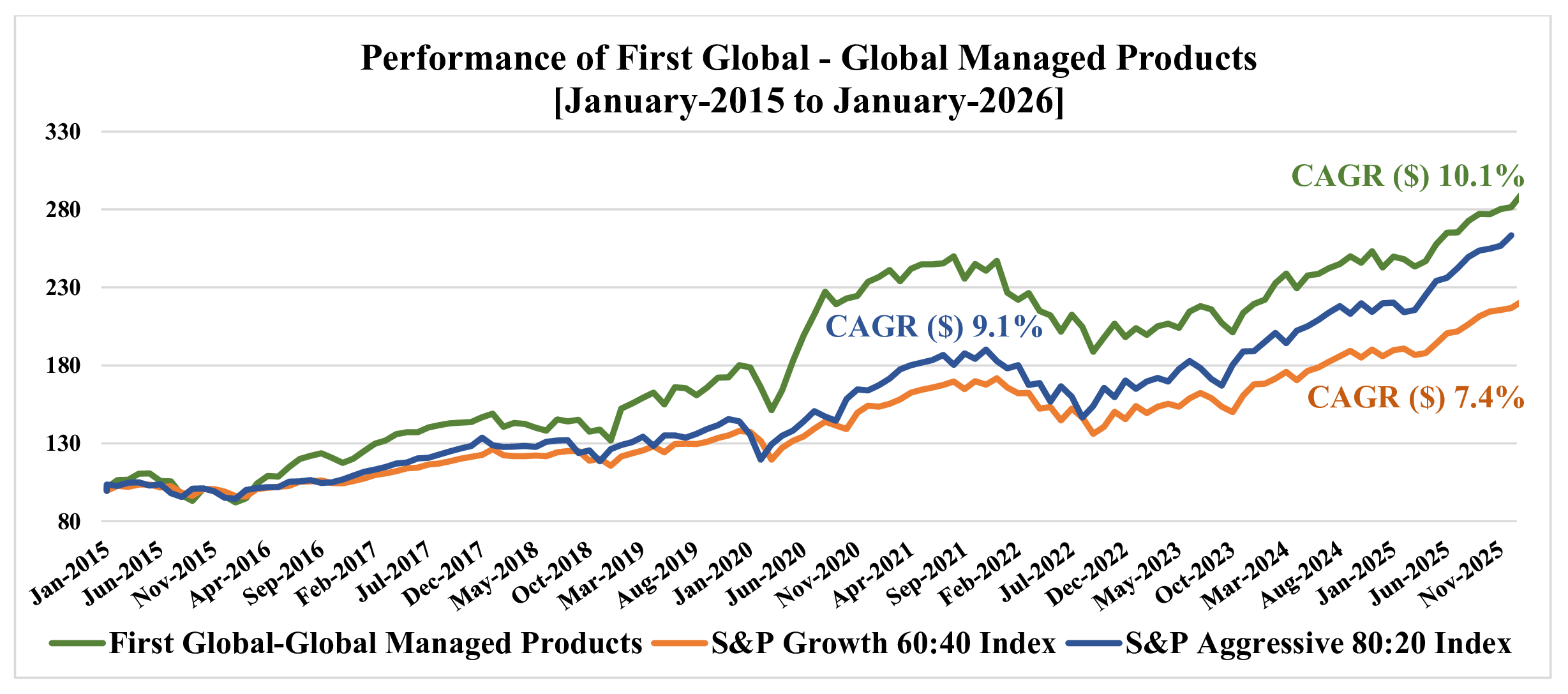

Wow Superb Returns🔥 Congratulations Chief for being Number 1 among all PMS!!!

You are one of the sharpest mind in Global Stock Market

AnupamM @moitraanupam

Congratulations Devina, results talk in itself!

Abhishek @simplyabhi21

Congratulations ma’am @devinamehra ! The consistency you have in maintaining the top rank position is outstanding! 👏

Mihir Shah @Mihir41Shah

We are learning More about markets (& Life ) thanks to U than we learnt in our Professional courses.A BIg Thank You, Wish all get Teachers Like You!!

Sumit Sharma @MediaSumit

"The ability to be comfortable with being outside consensus is a superpower in investing...and in life." Devina ji hits the nail on its head!

Majid Ahamed @MajidAhamed1

Congratulations @devinamehra mam! All the best for long term returns as well.

Vinay Kumar @VinayKu05949123

This is the wonderful session I have ever attended till date. One of the most fruitful hour of my life. Devina madam, ur clarity on financial mkts is simply superb.The way u portray the facts supported by "data" about stock mkts is really astonishing.I will listen again.Thanks.

VIJAY @drippingashes

I loved to read your journey, insight and philosophy. It's a pleasure to read and know of your takes on market and life.

MNC🏹 @Focus_SME

Check & follow @devinamehra's timeline for lots of post debunking such rosy stories. Also, she gives amazing 🤩 sector directions/hints.

KLN Murthy @KLNMurthy2016

Good actionable insights, great article!

Suresh Nair @gkumarsuresh

Devina Madam is simply terrific... good knowledge, straight and simple thinking.

Very difficult to emulate such traits. I listen her past interviews from youtube.

Respect...!!!!

DD @AliensDelight

One of the brightest minds in the world of finance :)

Radhakrishnan Chonat @RCxNair

📣 Calling all investors! Just had an incredible interview with @devinamehra, Chairperson and MD of First Global. We discussed the importance of global diversification, effective asset allocation, and the risks of sitting on the sidelines. Trust me, you don't want to miss this!

siddarthmohta @siddarthmohta

Excellent performance. Flexibility is the key as you have mentioned it earlier also. Cannot have finite rules for infinite mkt opportunities.

Boom (বুম)@Booombaastic

To be honest, the insights which Devina madam brings in is very enriching..have learnt a lot from them...

Himanssh Kukreja @Himansh02428907

One of the most accurate analysts :)

I always look forward to you interviews mam

Abhijeet Deshpande @AbhijeetD2018

Madam, It is always a treat to read your insight, not only on business but on other topics also!!

Dada.AI @dada_on_twit

Thanks for this wisdom ma'am. Always love hearing your thoughts on everything equity. :-)

adil @zinndadil

Excellent points!

Can clearly feel this thread is a product of marination of many books and years of experience. 👍

Kamal thakur @Kamalgt10

Superb !!

Your knowledge, analysis & articulation is simply great 👍

Tanay @Tanay36232730

Follower on Twitter and Subsciber on YouTube of First Global, really helping me in my investment desicion. Thanks